Understanding how much you will pay for car insurance before purchasing a policy is essential for budgeting and comparing providers. A car insurance calculator gives drivers a quick estimate of their monthly and yearly premiums based on personal details, driving history, and coverage needs. While it cannot predict the exact rate, it helps you understand a realistic price range and the factors insurers use when setting premiums.

This guide explains how car insurance calculators work, what information you need, and how to get the most accurate estimate for your situation.

Table of Contents

How a Car Insurance Calculator Works

A car insurance calculator uses your personal and vehicle data to generate a price estimate by analyzing:

- State insurance laws

- Risk factors

- Vehicle details

- Coverage choices

- Statistical pricing models

Insurance companies use similar rating systems, so an online calculator offers a close approximation of what you may pay.

Information You Need Before Using a Car Insurance Calculator

To get accurate results, you should have the following details ready:

Personal Information

- Age

- Home address or ZIP code

- Gender (in some states)

- Marital status

- Credit score estimate

Driving History

- Number of accidents

- Traffic violations

- Claims history

- Years of driving experience

Vehicle Information

- Year, make, and model

- Vehicle identification number (VIN), if available

- Safety features

- Annual mileage

Coverage Level

- Minimum liability

- Full coverage (liability, collision, comprehensive)

- Deductible amount

- Optional add-ons such as roadside assistance or rental coverage

The calculator uses this data to estimate your likely premium range.

Factors That Affect Your Car Insurance Costs

Insurance companies use more than a dozen factors to determine your price. A calculator includes these major ones:

1. Location

Your ZIP code affects your rate due to:

- Accident frequency

- Theft rates

- Medical costs

- State insurance laws

Urban areas generally have higher premiums.

2. Age and Experience

Younger drivers pay more because they are considered higher risk.

3. Vehicle Type

Luxury, sports, and high-value vehicles cost more to insure.

Cars with strong safety ratings are usually cheaper.

4. Coverage Choices

Full coverage costs more than minimum liability.

Higher deductibles lower your monthly cost.

5. Credit Score

In most U.S. states, better credit leads to cheaper rates.

6. Driving Record

At-fault accidents, DUIs, and speeding tickets raise your premium.

7. Annual Mileage

Drivers who spend more time on the road face higher risk.

How to Use a Car Insurance Calculator for the Best Results

1. Enter Accurate Information

Incorrect details can lead to misleading estimates. Always use real mileage and vehicle details.

2. Compare Multiple Coverage Levels

Calculate:

- Minimum state coverage

- Full coverage

- Higher vs. lower deductibles

This helps you determine the best balance between cost and protection.

3. Test Different Scenarios

Try adjusting:

- Your deductible

- Your coverage limits

- Optional add-ons

Small changes can significantly affect your price.

4. Use More Than One Calculator

Several insurers provide their own calculators. Try tools from:

- Geico

- Progressive

- State Farm

- Allstate

- NerdWallet

- The Zebra

Comparing multiple sources gives a clearer view of your true price range.

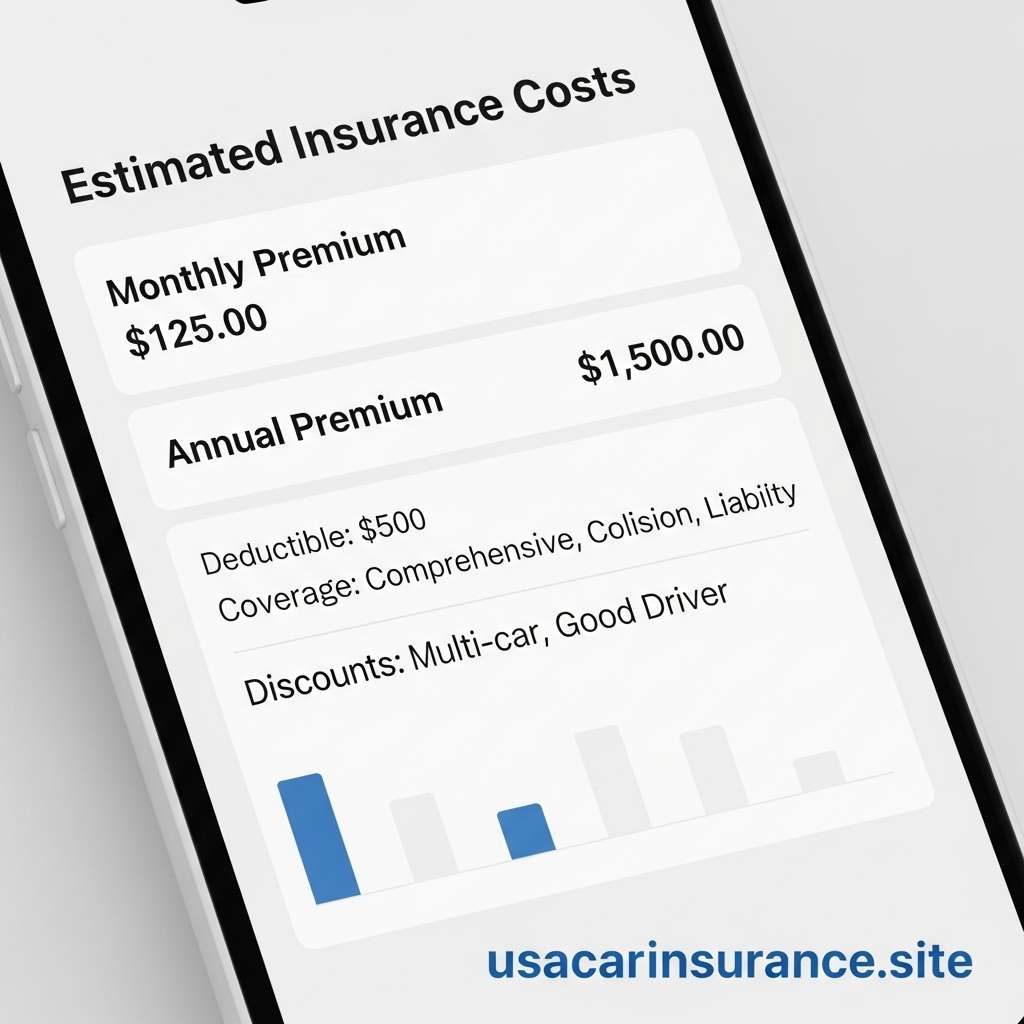

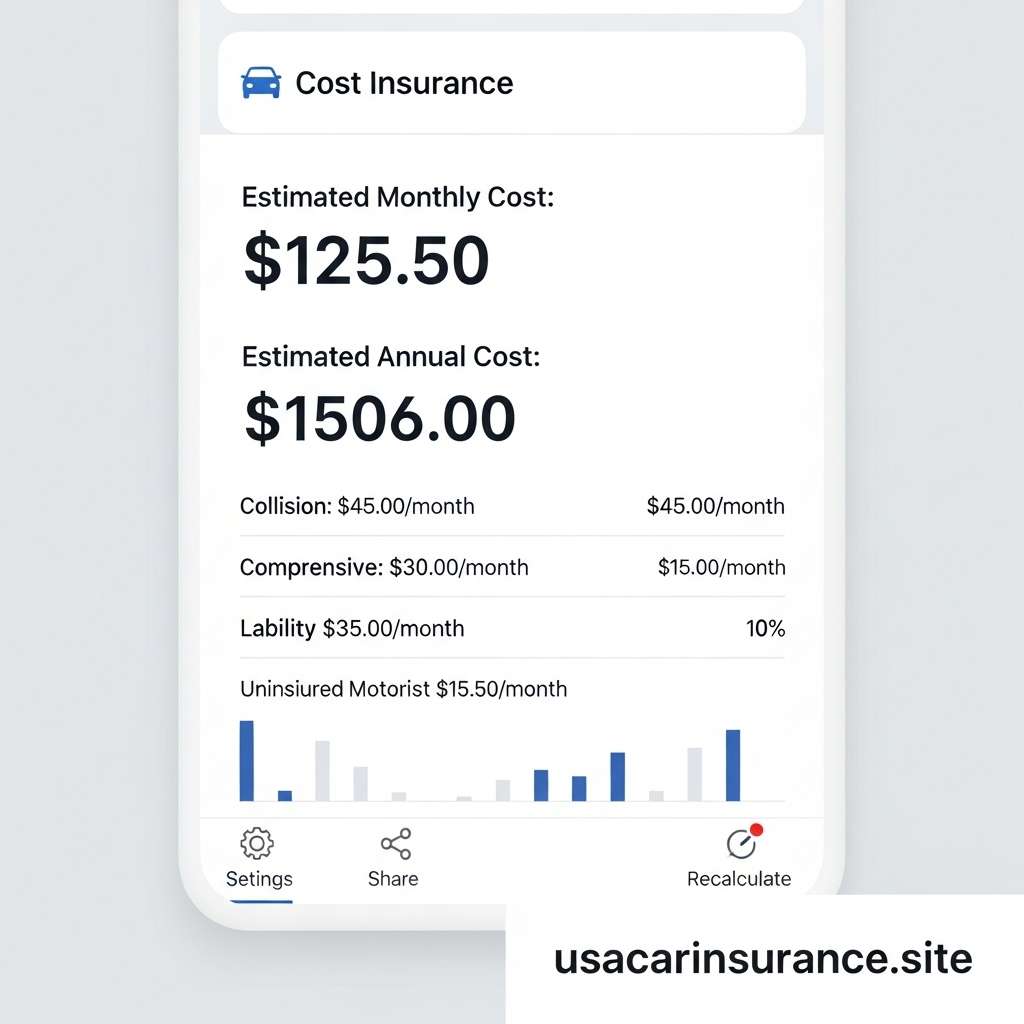

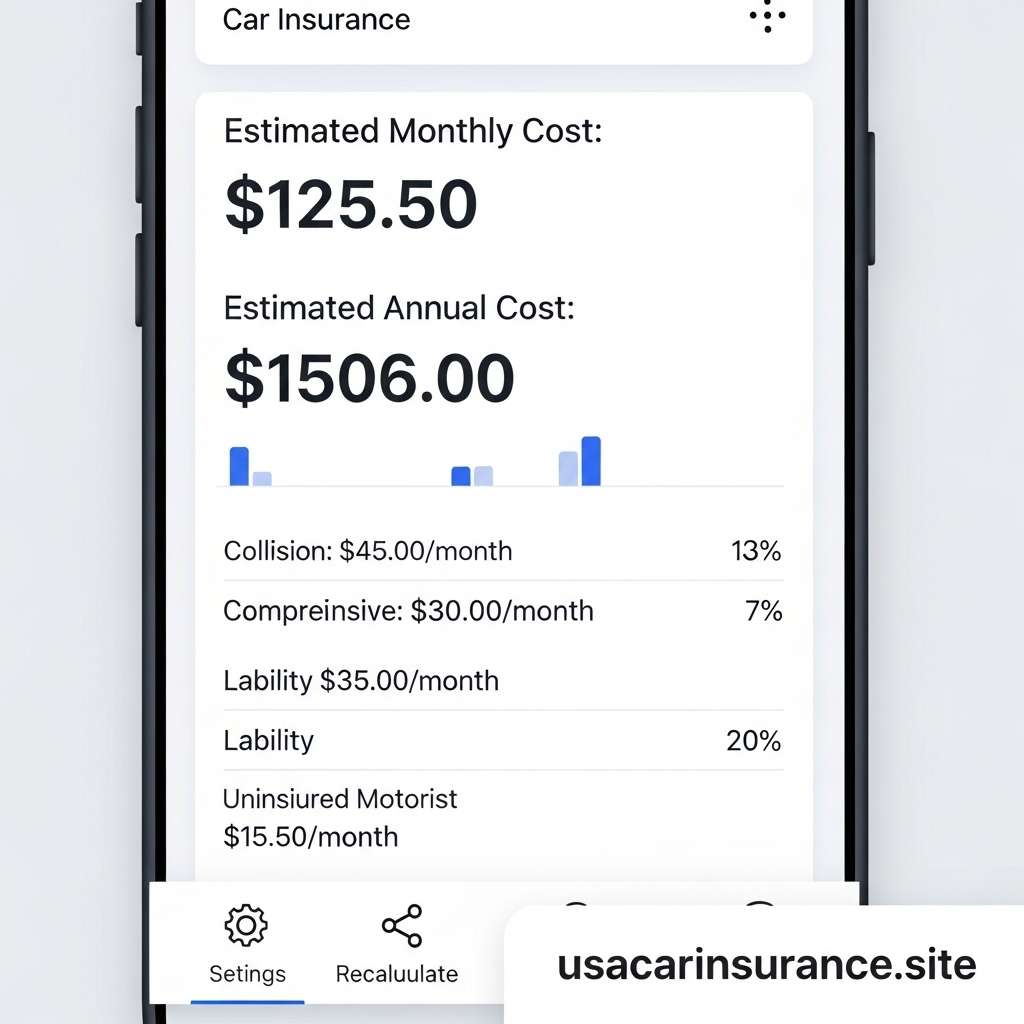

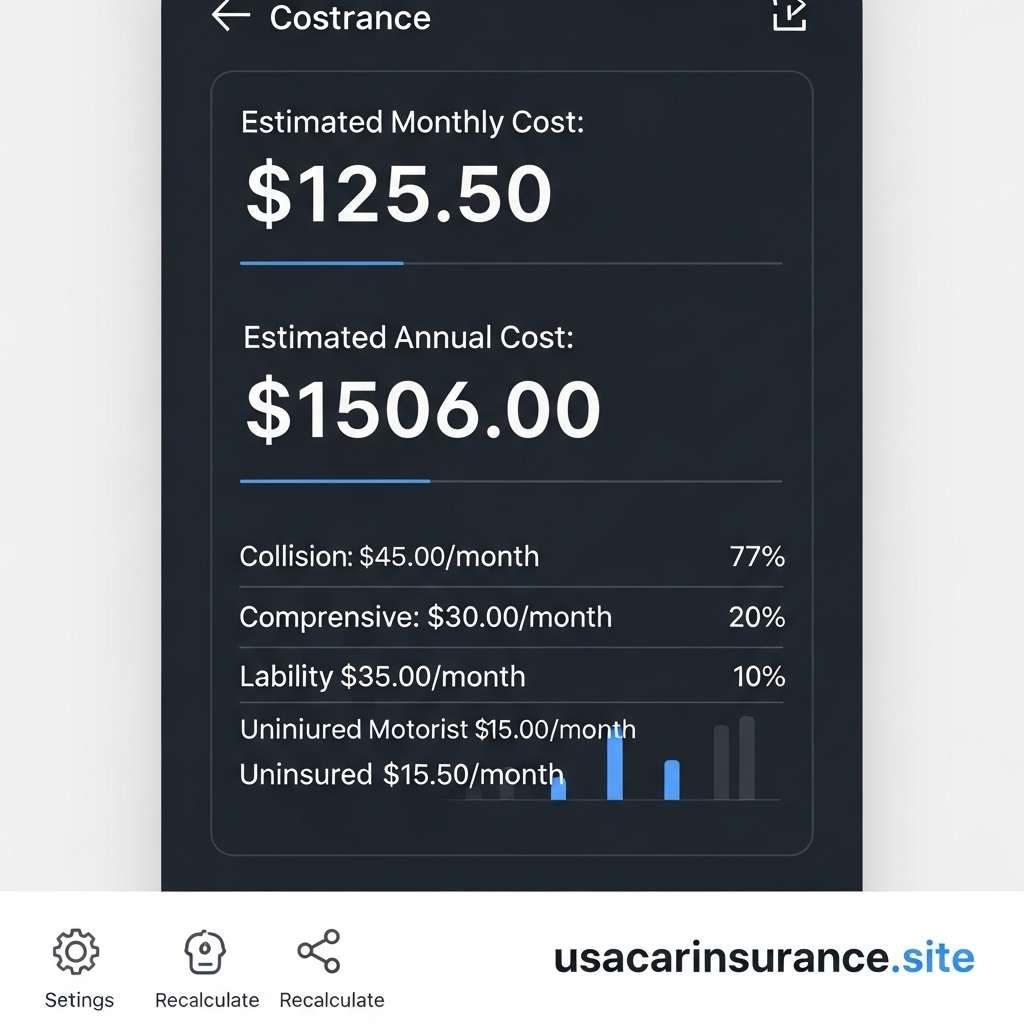

Monthly vs. Yearly Cost Estimates

A car insurance calculator typically shows:

Monthly Premium Example

$90 to $150 per month for an average full-coverage policy

Yearly Premium Example

$1,080 to $1,800 per year

Paying yearly often saves money because many insurers add fees to monthly payments.

How to Lower Your Estimated Car Insurance Cost

Before applying for insurance, you can reduce your projected cost by:

- Increasing your deductible

- Improving your credit score

- Removing unnecessary coverages

- Installing anti-theft devices

- Taking a defensive driving course

- Bundling home and auto insurance

- Completing safe driver programs

- Choosing a car with good safety ratings

Using these strategies in a calculator can show how much you might save.

Why a Calculator Is Not 100 Percent Exact

A calculator gives an estimate, not a final quote, because insurance companies may adjust your rate based on:

- Verified driving record

- Official claim history

- Actual credit score

- Undisclosed violations

- Additional underwriting rules

However, calculators still provide an accurate starting point for most drivers.

Conclusion

A car insurance calculator is one of the easiest tools for estimating your monthly and yearly costs before buying a policy. By entering accurate driver and vehicle details, comparing coverage levels, and adjusting inputs, you can understand what influences your rate and how to lower it. While estimates vary, these tools help you make informed decisions and find the best insurance for your budget.