If you want an instant car insurance quote, having the right information ready can help you get a fast, accurate estimate within minutes. Insurers rely on specific driver, vehicle, and coverage details to calculate your premium. The better prepared you are, the quicker you’ll receive a real price range that matches your situation.

This guide explains exactly what you need, how instant quotes work, and how to save time while getting the best possible rate.

Table of Contents

How Instant Car Insurance Quotes Work

Instant car insurance quotes use automated rating tools to analyze your information and provide a price in seconds. These tools evaluate:

- Your driving record

- Vehicle type

- Coverage selections

- Demographics

- State insurance laws

Once the data is entered, the system applies risk calculations and returns your estimated monthly and yearly premium.

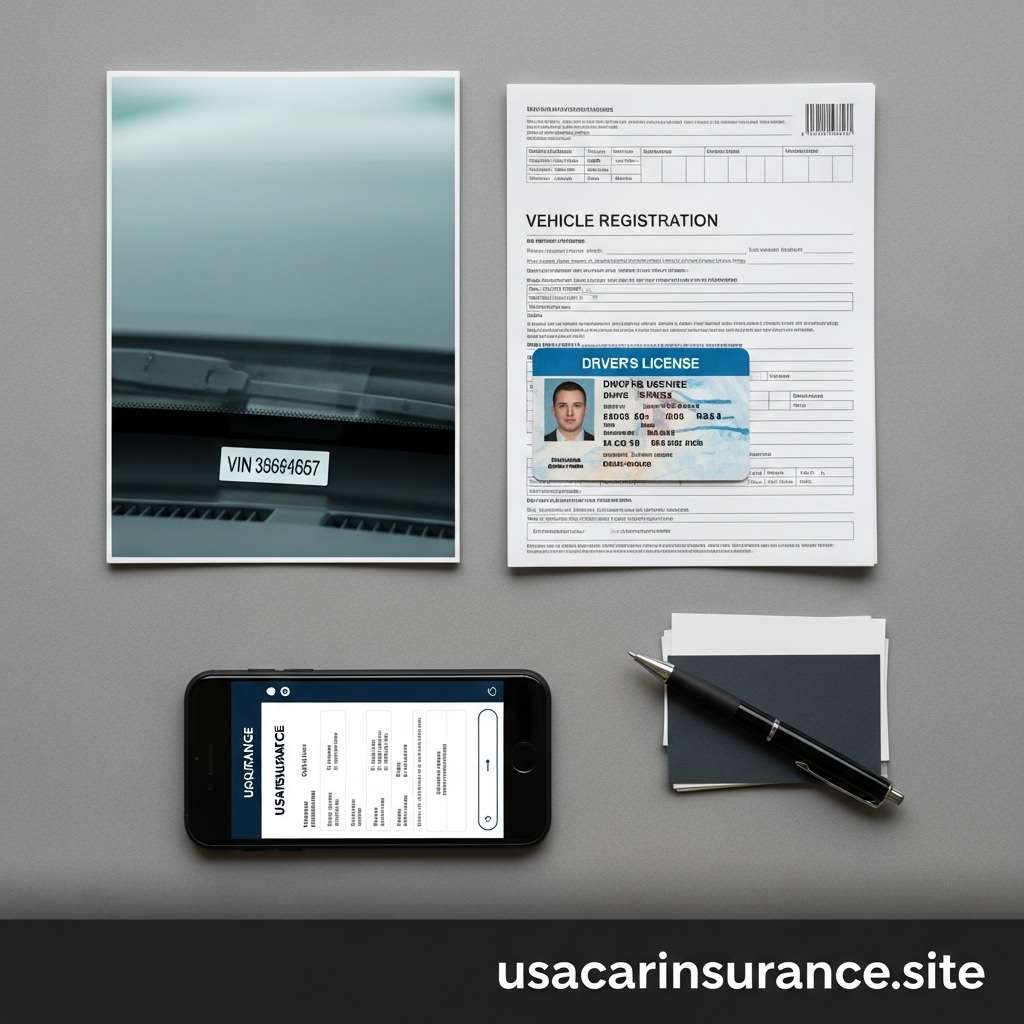

What You Need to Have Ready for the Fastest Quote

To get an accurate instant car insurance quote without delays, gather the following:

1. Personal Information

Insurers need this to verify your identity and assess your risk:

- Full name

- Date of birth

- Home address

- Driver’s license number

- Marital status

- Gender (in some states)

Accurate information ensures a precise estimate.

2. Driving History

You must provide:

- Number of years you’ve been licensed

- Past accidents

- Traffic violations

- Claims history

Even small details like parking tickets can influence your final rate.

3. Vehicle Information

Your vehicle directly affects the cost. Be ready with:

- Year, make, and model

- Vehicle Identification Number (VIN)

- Safety features installed

- Annual mileage

- Whether it’s financed or leased

Vehicles with better safety ratings usually cost less to insure.

4. Coverage Details

Decide the type of coverage you want before starting the quote:

- Liability-only

- Full coverage

- Comprehensive

- Collision

- Deductible amount

- Optional add-ons

This helps the calculator generate the right estimate faster.

5. Your Credit Score Estimate

In most states, credit is used to determine your premium.

Having at least a rough number ensures the quote is realistic.

How to Get the Most Accurate Instant Quote

1. Enter Information Honestly

Inaccurate details can lower your quote temporarily but will increase the price later during verification.

2. Use Multiple Insurance Sites

Get quotes from companies like:

- Geico

- Progressive

- State Farm

- Allstate

- Nationwide

Each insurer uses different rating models.

3. Compare the Same Coverage Levels

Always match:

- Deductibles

- Limits

- Add-ons

This ensures each quote is comparable.

4. Check Your Quote at Different Times

Rates can change due to:

- Market conditions

- State filings

- Discounts becoming available

Reviewing multiple quotes can help you catch a better price.

How Fast Is an Instant Car Insurance Quote?

Most insurers provide a price in:

- 30 seconds to 2 minutes for basic information

- Up to 5 minutes if you enter full vehicle and driving history

The more details you enter, the more accurate the quote becomes.

Common Mistakes That Slow Down the Process

Avoid these issues to receive your quote instantly:

- Entering the wrong VIN

- Guessing your mileage

- Forgetting past claims

- Using outdated driver’s license information

- Not knowing your current coverage level

Correcting these later can delay approval or change your final rate.

Ways to Lower Your Instant Car Insurance Quote

Before requesting the quote, consider these cost-saving options:

- Raise your deductible

- Remove unnecessary extras

- Improve your credit score

- Bundle home and auto insurance

- Install anti-theft devices

- Take a defensive driving course

- Join safe-driver telematics programs

Trying different combinations in the quote tool can show you how much you could save.

Conclusion

An instant car insurance quote is one of the quickest ways to understand your potential monthly and yearly insurance costs. By preparing your personal, vehicle, and driving details in advance, you can get an accurate estimate within minutes. Using multiple insurers and keeping your information updated ensures you find the best price available in your state.